A beautiful property in Rushmere I had the pleasure of listing and selling in 2024

Before getting into more formal statistics, here is my summary of the Invermere & Area real estate market for 2024: 'choppy, uncertain, up & down'. In February there was a flurry of activity, both for new listings and some quick sales, some relatively high selling prices. And then things seemed to stall in March. There was another flurry of activity early May, both with new listings and new sales, followed by a very slow June. During July and August there were lots of showings and a decent volume of sales, but generally I found that many buyers were waiting, waiting to see how much interest rates would go down, waiting to see if more listings would come, waiting to see if prices would come down.

September, October, and November of 2024 were surprisingly busy considering how slow/choppy 2024 had been for sales. The stats may not be completely accurate as myself and likely other agents had a few expired listings sell in the fall. A number of listings that had been sitting on the market sold, and newer listings also sold. Although there were a steady flow of new listings through the fall of 2024, but a lot of these were for condos at Panorama and building lots (weaker demand) and not for single family homes in Invermere or Windermere (where there is strong pent up demand). December 2024 was very slow, but not as slow as December 2023 which was one of the slowest months for sales on record for many many years.

As writing this, middle of January 2025, things seem to be heating up a bit, some new listings or potential new listings are likely coming for February, there are some inquiries from buyers, but so far no urgency from buyers and not many new sales on the books. With lower interest rates and some of the fears of prices decreasing gone, it could be a busy spring, especially for single family homes in Invermere and lake access cabins on the Eastside of Lake Windermere. My best prediction for the year to come is that we will continue to see seasonal swings, waves of activity, for popular types of properties there could be multiple offers but other types of listings could sit on the market for a long time, really a bit of a mixed bag. But when looking at historical averages- I predict fairly stable and normal total sales activity, likely similar volumes to 2024 & 2023.

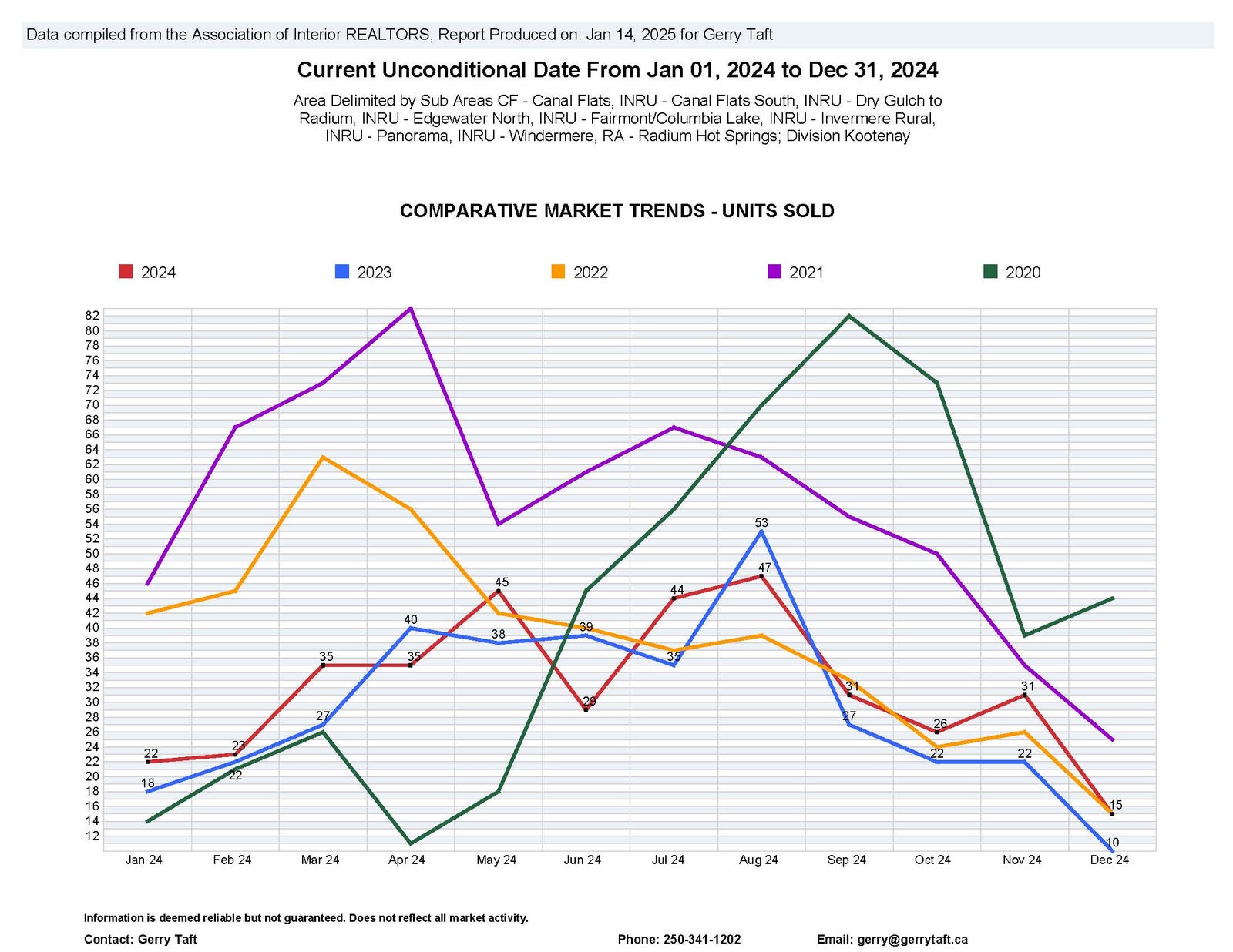

Here is a more detailed dive into historical volume of "units" sold throughout the Columbia Valley (for all property types) by month over the last four years. During 2020, volume dropped to almost nothing in April & May during the start of the uncertainty of COVID (but those few brave people who purchased got amazing value), and the volume shot up in the fall of 2020, ending at 499 sales for the year (compared to 290 sales in 2019). The crazy pace continued during the winter and spring of 2021, with still steady volume through the rest of the year, resulting in a eye water number of sales of 679 for the year. 2022 saw a return to more normal seasonal patters, but still the volume of sales was high at 462. 2023 & 2024 saw a real return to total number of sales and seasonal patters, 353 sales for 2023 & 383 for 2024. To look back further in time, 2018 had 316 sales, and 2017 had 333.

Although it is interesting to look at the numbers and seasonal cycles, the reality is that there are qualified buyers looking to buy all of the time (and the best time to buy is when you are financially and emotionally ready), and if a property is fairly priced and reasonably stagged (it doesn't have to be perfect)- the right time to sell is when you are ready (but hopefully before you HAVE TO).

On the buying side, there is risk to waiting on the side-lines too long, generally prices don't go down and if a property or home meets most of your requirements there is no guarantee that something better will come up in the near term. I know many people who regret not buying in 2021 or 2022, even though it was busy, prices were lower compared to today.

On the selling side, there is opportunity costs, holding to higher value with the hopes of getting an extra $10,000 or $20,000 could impact making the move or changes in your life, could limit money you could invest elsewhere. In the scheme of things and over the long term, this extra money is not likely to change a person's lifestyle dramatically, but taking an extra six months or year to sell- or not selling at all, could have a major impact. This is especially relevant when the property has been in the family for a long time and it may have dated elements or need some upgrades. The reality is that cost in is not that high, a future buyer is going to incur costs. It may sound a bit harsh, but don't get too greedy! Yes maximize value, but also try to remove some of the emotional value.

Whether you are looking to buy or sell, I think that 2025 represents a fairly balanced market and it could be the perfect time (if it is the right time for you)! If you would like REAL & honest, no BS real estate advice- I am happy to help!

Gerry